Carbon credits enable companies to offset their emissions through a structured system. This guide explores the essentials of carbon credits, including their types, verification processes, and the functioning of carbon markets. It also highlights how businesses can actively reduce their carbon footprint using EcoCart’s tools, offering a direct path to environmental responsibility and sustainability.

What Are Carbon Credits?

A carbon credit is a tradable certificate or permit that represents the right to emit one tonne of carbon dioxide (CO2) or the mass of another greenhouse gas equivalent (CO2e) taken from the atmosphere. This concept is central to cap-and-trade systems, where businesses are allocated a certain amount of allowable greenhouse gas emissions. If a company exceeds this limit, it must purchase carbon credits to offset the excess emissions.

This mechanism aims to incentivize companies to reduce their carbon footprint by either adhering to their emission allowances or investing in projects that reduce or remove greenhouse gasses from the atmosphere.

The cap-and-trade system might seem to offer a loophole for companies to simply buy their way out of environmental responsibility. However, the reality is more complex and encouraging. Compliance carbon markets, where these credits are traded, are tightly regulated. The cost of carbon credits is on the rise, driven by increasing demand, stricter environmental regulations, and the scarcity of high-quality offset projects. This escalating price trend makes relying solely on purchasing credits to meet regulatory requirements less viable, pushing companies towards adopting more sustainable operational practices.

Moreover, carbon credits play a crucial role in managing overall carbon emissions. They allow for a predictable net carbon output, with some companies emitting less and others more than their allowances. Regulatory bodies gradually lower these allowances, driving a consistent reduction in carbon emissions across industries. This system not only helps in the fight against climate change but also signals to consumers the commitment of businesses to sustainability.

Download our FREE ebook:

How are carbon credits verified?

Carbon credit verification is becoming more and more standardized as the markets grow. The verified carbon standard developed by third-party organization Verra is a widely adopted program, along with the Gold Standard and the American Carbon Registry. These organizations all require a rigorous assessment before the project is approved and can issue Verified Carbon Units (VCUs) using the same “one metric tonne of carbon dioxide removed” scale as the carbon markets.

Who issues carbon credits?

Carbon credits are issued by a variety of entities, tracing back to the establishment of the carbon credit system under the Kyoto Protocol in 1997. This international agreement set quotas on greenhouse gas emissions for countries, particularly industrialized ones, introducing the concept of emission caps.

To clarify, while governments or their designated regulatory agencies primarily issue carbon caps, carbon credits themselves can be issued by both governmental and non-governmental organizations. A notable example of a non-governmental body involved in issuing carbon credits is the Clean Development Mechanism (CDM) under the United Nations. This system allows for the creation and exchange of carbon credits through projects aimed at reducing emissions in developing countries, thereby contributing to the global effort to mitigate climate change.

Types Of Carbon Credits

There are two types of carbon credits on the market: certified emissions reduction (CER) and voluntary emissions reduction (VER). While CERs are regulated through carbon credit institutions to offset emissions from specific projects, VERs exist in the Voluntary Carbon Market and carry no official third-party management.

Certified emissions reduction (CER)

Certified emissions reductions are developed under the Clean Development Mechanism (CDM) and are strictly regulated. They are typically assigned to a project via an emission reduction purchase agreement (ERPA). Essentially, the project will purchase the CERs that will allow them to emit a certain amount of carbon throughout the project.

Voluntary emissions reduction (VER)

Voluntary emissions reductions are traded on the voluntary carbon market and carry no third-party oversight. These types of carbon credits can be created by carbon projects or carbon reduction tactics (such as installing solar panels or windmills) and can then be sold and traded on the public market. Although VERs are not as regulated as CERs, they must be validated and verified by major carbon standards in order to be considered valid. The carbon offsets enjoyed from EcoCart’s carbon projects are VERs that are all accredited by VERRA’s Verified Carbon Standard.

How Carbon Markets Work

A carbon offsets market is a trading system where carbon credits, each equaling one metric tonne of greenhouse gas emissions, are bought and traded. In cap and trade systems, governments limit the amount of carbon credits available and assign limits according to the company and industry. Companies that do not use all of their carbon credits can then trade their credits with high-emitting companies that expect to exceed their limits. In other programs, entities can create carbon credits by reducing or removing carbon emissions through actions such as adding solar panels or reforestation projects. They can then sell those carbon credits to companies looking to address their carbon footprint.

How to buy carbon credits

If you’re looking to invest in carbon credits, a number of companies can help you get started. Indigo Carbon, Nori, and Truterra Carbon Program are some companies selling carbon credits. You can also find carbon credit companies on Climate Action Reserve’s Carbon Market Directory.

How to sell carbon credits

In order to sell carbon credits, you first need to create them. This can be done by either removing or reducing carbon emissions in a verified and measurable manner. Each tonne of carbon removed or reduced equals one carbon credit. These credits will then be sold on the Voluntary Carbon Market.

Carbon emissions can be reduced by investing in solar panels or wind power. Carbon reduction projects refer to projects that remove and store carbon dioxide, such as reforestation projects or carbon capture technology. In order to sell carbon credits using either approach, you must become verified by a third party that follows major carbon standards such as the American Carbon Registry, the Climate Action Reserve, or the Gold Standard. To get verified, you will need to provide data proving carbon reduction and removal, and the third-party verifier will go over the data to ensure compliance and assign the credits accordingly. You can then sell the carbon credits by registering with a carbon offset registry.

How much do companies pay for carbon credits?

The cost of a carbon credit can vary due to the market; for example, the low availability of unused credits in a compliance cap-and-trade market could drive the price up. Regulators are slowly increasing the cost over time as the allowance for emissions is reduced to ensure businesses are constantly improving their ability to reduce their carbon footprint. Also, some people trade carbon credits to turn a profit, just like any market, so be careful to research the effective carbon rates before your company makes a purchase.

How Large Is The Carbon Market?

The short answer? It’s huge—and it’s growing. There are 32 emissions trading systems or carbon markets globally with a market value of USD 949 billion. According to the World Bank, those 32 emissions trading systems are in 39 nations, including Canada, Mexico, Brazil, Nigeria, the EU, China, and Indonesia, to name just a few.

Carbon Projects

Carbon projects are verified programs that remove carbon dioxide from the atmosphere through conservation, reforestation, carbon capture technology, etc. In order for carbon projects to convert into carbon credits, they must be verified by a third party and proven to be measurable, additional, and permanent.

For each tonne of greenhouse gasses that is removed from the atmosphere as a result of a carbon project, a carbon credit is assigned, which can then be sold to a company looking to offset one tonne of carbon emissions. So, a credit becomes an offset when it’s used to compensate for a portion of an entity’s emissions.

In this way, companies and individuals can address their emissions by helping to fund projects that remove the carbon dioxide from the environment that they cannot yet remove from operations. Take a look at EcoCart’s impact projects to see carbon projects in action.

Want to know where your business stands? Get your sustainability scorecard with our quiz:

Carbon credits vs. carbon offsets

Carbon credits are created as a result of a carbon project. After a carbon project receives third-party verification that one tonne of carbon dioxide has been removed from the atmosphere, it can translate into a carbon credit. That credit can then be sold to a company that needs to offset one tonne of carbon emissions from their operations. Once that company has spent that carbon credit, it becomes a carbon offset, as the company has traded the credit for one tonne of emissions. Purchasing credits in order to offset emissions is a popular way for eco-conscious businesses to mitigate greenhouse gas emissions and the harm done to the planet by their operations while they work to improve their business practices and make them more sustainable.

For buyers, it’s critical to purchase carbon offsets that have been approved by a third-party organization against reputable carbon standards. That way, you can be confident you’ll have the impact you want. Here at Ecocart, we only support verified carbon projects that meet rigorous standards to give our clients that same peace of mind.

As we mentioned, carbon credits are a transaction instrument to measure carbon emissions. Carbon credits are available for purchase in both compliance and voluntary carbon markets. So for example, a corporation operating in a compliance market meets its emissions target and uses all its carbon credits. That same corporation could still buy credits from carbon offset projects in the voluntary market to increase its impact! Many companies buy carbon offsets to further their corporate social responsibility (CSR) commitments or their environmental, social, and governance (ESG) goals.

Read more: Carbon Credits vs Carbon Offsets

Challenges And Opportunities For Global Adoption Of Carbon Credits

As with any emerging industry, there are challenges to the carbon pricing uptake globally. Let’s look at what you need to know next.

Defining shared principles

While most carbon pricing schemes agree on the unit of measurement—one metric tonne—some of the rest is up in the air. With a proliferation of carbon credit companies, carbon offset projects, and multiple ways to become verified, it’s no wonder businesses are confused. Climate advocates at verification companies and international conferences such as COP27 are pushing for the industry to decide on one global standard before governments get involved.

Standardizing terms across contracts

And there are a lot of terms! Some carbon credit brokers sell their version of a carbon credit, like Nori’s “Nori Carbon Removal Tonnes” (NRTs). Others are just credits. But it does make it more complicated to comparison-shop.

Maintaining market integrity

This is a big one. Without consistent verification integrity, it won’t be long until fake or intentionally misleading carbon credits proliferate the market, breaking trust in the system and possibly undoing the work of the Kyoto and Paris Accords that pushed for carbon pricing in the first place. Eco-conscious businesses can’t let this happen. As purchasers of carbon credits, we should also have a voice in regulations as they change.

What Can Businesses Do To Mitigate Carbon Emissions?

Businesses seeking to reduce their carbon footprint can turn to EcoCart for effective solutions. EcoCart’s carbon footprint dashboard empowers companies to identify and eliminate excess carbon emissions, streamlining the path towards sustainability. Beyond tracking emissions, EcoCart offers carbon offsetting, allowing businesses to invest in global environmental projects that counterbalance their carbon output.

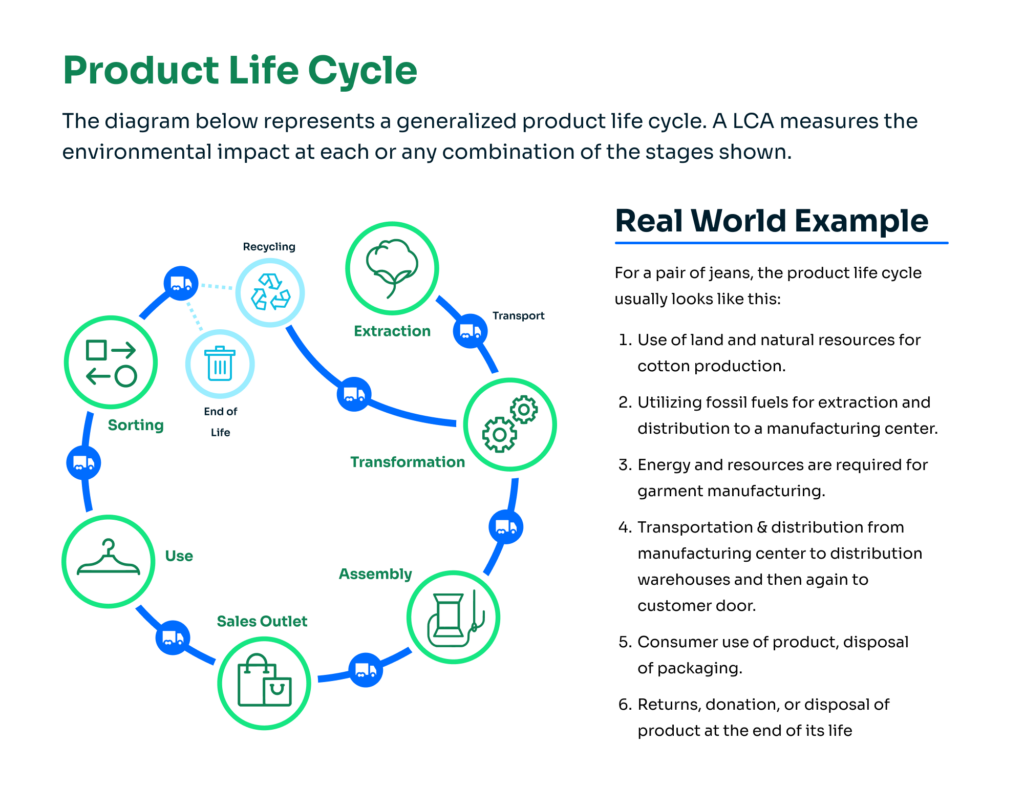

EcoCart also provides life cycle analysis tools, giving insights into the environmental impact of products from creation to disposal. This comprehensive approach helps businesses make informed decisions to minimize their ecological footprint.

For businesses ready to take action, EcoCart.io is the gateway to a suite of tools designed for sustainability. By partnering with EcoCart, companies not only contribute to a healthier planet but also align with consumer values of environmental responsibility. Start your journey towards sustainability with EcoCart today and make a tangible impact on the planet’s future. Request a demo to get started.