Carbon credits offer a unique opportunity for businesses and individuals to contribute positively to the global fight against climate change. Whether you’re looking to sell carbon offsets or purchase credits to achieve sustainability goals, understanding how to get paid for carbon credits will bring it all together for you. This guide is designed to demystify the complexities of the carbon market, guiding you through the creation, verification, and sale of carbon credits.

In this guide, we’ll walk you through:

- exactly what carbon credits are,

- the recent and potential growth of the carbon market,

- and how to generate carbon credits and get paid for them.

What Is A Carbon Credit?

Carbon credits are a market-based tool used to help offset greenhouse gas emissions (GHGs). One carbon credit represents the removal or avoidance of one metric tonne of carbon dioxide or its equivalent (CO2e) in another GHG—including methane (CH4), nitrous oxide (N2O), or fluorinated gasses—from the atmosphere.

You can learn more about how carbon credits are verified here.

How Are Carbon Credits Created?

Carbon credits are generated through two primary means:

- Government-issued cap-and-trade programs

- Voluntary carbon offset projects

Download our FREE ebook:

Compliance Market

Compliance carbon markets use a cap-and-trade system to limit the amount of greenhouse gasses companies can emit by allocating them an emissions cap, which decreases over time. Companies that emit below the set limit earn sellable credits. The companies that emit more than their allocated limit can purchase these surplus credits.

This market-based system incentivizes private companies to reduce their GHG emissions in two ways:

- by imposing additional costs on emissions that exceed an allocated limit and

- by providing opportunities to generate revenue by selling excess allowances after successfully decreasing emissions.

To effectively participate in cap-and-trade systems and ensure compliance with their verification and validation requirements, you’ll want to thoroughly investigate the specific cap-and-trade program in which you are participating, familiarizing yourself with its unique regulatory framework, reporting obligations, and verification processes. Let’s focus on three major systems: the European Union Emissions Trading System (EU ETS), California’s Cap-and-Trade Program, and the Regional Greenhouse Gas Initiative (RGGI).

- European Union Emissions Trading System (EU ETS): Encompasses over 11,000 power stations and industrial plants, plus airlines within the EU. Allocations are primarily via auction, with some free allocations to prevent carbon leakage. Entities participate by opening a national registry account, submitting annually verified emission reports, and surrendering allowances accordingly.

- California’s Cap-and-Trade Program: Targets large GHG emitters across various sectors, including industrial plants and fuel distributors, with a threshold of 25,000 metric tons of CO2e annually. It combines free allocations with quarterly auctions for allowance distribution. Facilities must report and verify emissions annually through CARB-accredited verifiers to comply.

- Regional Greenhouse Gas Initiative (RGGI): A cooperative effort among Northeastern and Mid-Atlantic states focusing on power sector emissions, applicable to power plants larger than 25 megawatts that primarily use fossil fuel. Allowances are sold through auctions, funding energy efficiency and renewable programs. Participants must follow RGGI’s MRV Guidelines for emissions monitoring, reporting, and verification by accredited verifiers.

Voluntary Market

Voluntary carbon offset credits, on the other hand, are created through carbon offset projects, which are typically run by non-governmental organizations or private entities. These projects can include a range of activities that aim to avoid GHG emissions or capture carbon from the atmosphere.

For example, a reforestation project that involves planting trees to absorb carbon dioxide from the atmosphere can produce carbon credits based on the amount of carbon that the trees sequester over time. Once a third party verifies these projects, the resulting carbon credits can then be sold to individuals or companies seeking to offset their emissions.

Why Selling Carbon Credits Is A Profitable Venture

The carbon credit market is projected to experience significant growth in the coming years. Last year, Refinitiv reported that the value of traded global markets for carbon dioxide permits grew by 164 percent to a record 760 billion euros (US$851B), indicating the increasing value of carbon credits and their potential financial benefits for businesses.

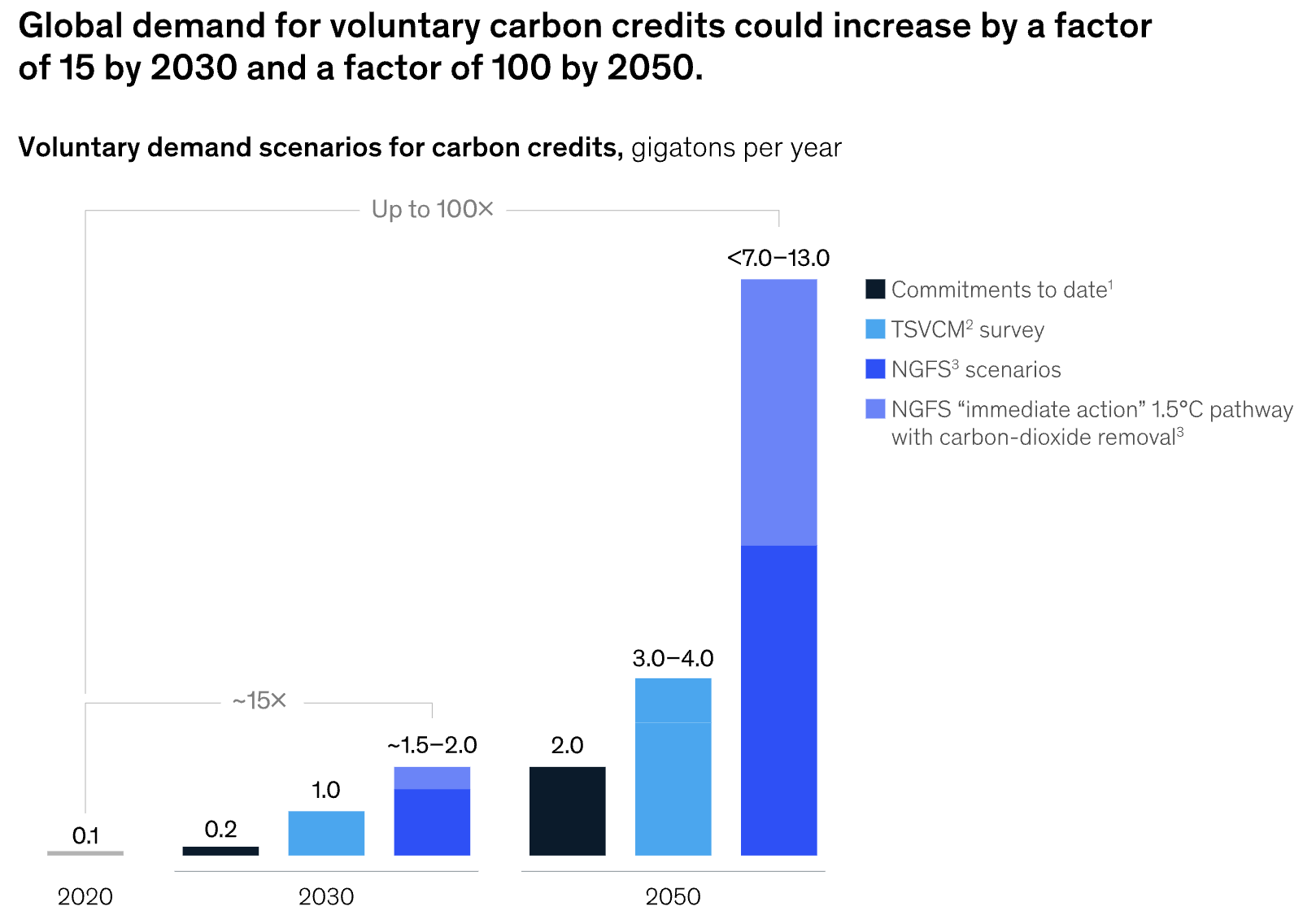

The demand for carbon credits is also expected to continue to rise, with the market projected to grow at a compound annual growth rate (CAGR) of nearly 31 percent from 2020 through 2027, reaching a value of $2.4 trillion. And the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) has projected that the demand for carbon credits will increase by 15 times or more by 2030 and up to 100 times by 2050.

Both findings indicate a potential for substantial growth in the carbon credit market.

What’s more, trading in carbon credits could reduce the cost of implementing Nationally Determined Contributions (NDCs) by up to $250 billion by 2030. NDCs are an integral part of the Paris Agreement, which outlines each country’s plan to reduce national emissions and adapt to climate change.

This further emphasizes the financial potential of selling carbon credits.

How to Get Paid for Carbon Credits, Step-by-Step

First, familiarize yourself with what carbon credits are, how carbon offsets work, and the principles behind carbon offsetting. Once you have a firm understanding of how carbon credits are created and used, you can begin the process of getting carbon credits to sell.

This process requires adherence to specific standards and regulations, as well as ongoing management and verification to ensure the integrity and effectiveness of the carbon credits generated. Each step involves careful planning and execution to sell carbon credits.

1. Assess Eligibility

Determine if your project or business activities qualify for generating carbon credits. To qualify, projects must effectively contribute to carbon avoidance or sequestration in ways that are additional to what would occur in a normal business scenario. This means the project should deliver benefits that wouldn’t happen without the specific intervention, ensuring that the avoidance or removals of greenhouse gasses are genuine and substantial.

Most importantly, the outcomes must be quantifiable and verifiable, adhering to established standards and methodologies to ensure integrity and credibility.

To navigate this process, here are the general steps for assessing eligibility:

- Conduct a Baseline Assessment: Before starting, analyze your current operations to establish a baseline of emissions. This will help identify potential areas for reduction and set a reference point against which the impact of any new project can be measured. EcoCart’s Life Cycle Assessment is a great place to start.

- Review Additionality Criteria: Investigate what constitutes ‘additional’ actions within your sector. For example, if you’re in agriculture, converting to no-till farming practices might be considered additional if the norm is conventional tilling. This change can lead to significant carbon sequestration in the soil, qualifying for carbon credits.

- Understand Verifiability Requirements: Ensure that the carbon savings your project aims to achieve can be accurately measured and verified. For instance, if installing solar panels reduces reliance on fossil fuels, you should be able to calculate the exact amount of emissions were avoided. Use established methodologies for measuring and reporting emissions savings.

- Explore Recognized Standards: Familiarize yourself with carbon credit standards such as the Verified Carbon Standard (VCS) by Verra, the Gold Standard, or others relevant to your industry. Each has specific eligibility criteria and project categories. Identifying the standard most aligned with your project will guide you in structuring your activities to meet eligibility requirements. We will go through these in detail in the following sections.

- Seek Expert Consultation: Consider consulting with carbon credit professionals or entities that specialize in carbon project development. These experts can provide valuable insights into the eligibility of your project and advise on how to structure it to meet the necessary criteria.

- Evaluate Project Impact: Assess the potential impact of your project beyond greenhouse gas reductions. Many standards also consider projects’ contributions to local communities, biodiversity, and sustainable development goals. Projects that offer broader environmental or social benefits might find easier pathways to eligibility.

- Document Everything: From the initial planning stages, meticulously document all aspects of your project. This includes baseline data, project design documents, methodologies used for calculating reductions, and any changes made to business-as-usual operations. Thorough documentation is crucial for the verification process.

2. Develop a Carbon Project

Developing a carbon project can take various forms, depending on the industry, geographic location, and available resources. The primary aim is to implement practices or technologies that have a significant, measurable impact on carbon emissions.

From agricultural adjustments to energy innovations, each project contributes to the global effort of mitigating climate change. The process begins with identifying an area where emissions can be effectively avoided or where carbon can be sequestered naturally.

Following this, a detailed plan is developed, outlining the methods to be used, the expected impact, and how the project will be managed and verified. It’s a collaborative effort that requires expertise, commitment, and often, the engagement of the local community or industry stakeholders.

Here is a list of examples illustrating the diverse ways to create a carbon project:

- Integrating trees into agricultural lands to combine crop production with forestry for enhanced carbon sequestration and biodiversity.

- Adopting crop rotation with legumes to improve soil health and fix atmospheric nitrogen, reducing the need for synthetic fertilizers.

- Transitioning to organic farming practices to enhance soil carbon storage and minimize chemical input.

- Restoring degraded wetlands to capture carbon and improve ecosystem resilience.

- Implementing managed grazing practices to increase soil organic matter and enhance pasture productivity.

- Establishing green infrastructure in urban areas, such as parks and green roofs, to absorb CO2 and improve air quality.

- Installing biogas systems to convert agricultural waste into renewable energy, reducing methane emissions.

- Incorporating solar panels into farming operations to produce renewable energy while maintaining agricultural land use.

- Applying precision agriculture technologies to optimize inputs and reduce the carbon footprint of farming practices.

- Exploring carbon capture and storage (CCS) or utilization (CCU) technologies to remove industrial CO2 emissions.

- Integrating sustainable cash crops, such as coffee or cocoa, into your project can boost economic viability alongside environmental benefits, marrying financial returns with carbon sequestration efforts.

3. Quantify Carbon Reductions

Quantifying carbon reductions is a fundamental aspect of developing a carbon project, ensuring that the emissions reductions or removals are accurately measured. This process relies heavily on established methodologies approved by major carbon standards, which provide frameworks for calculating and reporting emissions savings in a consistent and verifiable manner.

Each of these standards and their methodologies ensure that carbon removal or avoidance projects can accurately measure their impact in a way that is transparent, verifiable, and in line with global best practices. For project developers, choosing the right methodology is crucial, as it not only impacts the credibility and saleability of the carbon credits but also aligns the project with broader environmental and sustainability goals.

Here’s an overview of recognized methodologies by major carbon standards:

Verified Carbon Standard (VCS) by Verra

Verra’s VCS Program is one of the largest and most widely used standards for accounting for carbon reductions and removals. It provides a robust framework for validating and verifying carbon offset projects across a wide variety of sectors. Verra categorizes its methodologies into several sectoral scopes that cover a broad range of activities, ensuring projects can measure their emission reductions or removals accurately. You can see all available Verra methodologies here.

All of EcoCart’s Impact Projects are verified by the Verra standard.

Gold Standard

The Gold Standard specializes in projects that not only aim to remove or avoid carbon emissions but also significantly contribute to broader sustainable development goals (SDGs). Recognizing the intricate link between carbon mitigation projects and sustainable development, the Gold Standard methodologies are crafted to ensure that projects can quantitatively and qualitatively measure their impacts across multiple SDGs.

These methodologies span a wide range of activities, focusing on clean energy, water purification, waste management, and land use, among others. By employing these methodologies, projects are encouraged to demonstrate their contributions towards achieving SDG targets, such as promoting good health and well-being (SDG 3), ensuring access to clean water and sanitation (SDG 6), and supporting affordable and clean energy (SDG 7).

This holistic approach not only quantifies the carbon reductions or removals but also assesses the project’s impact on local communities, economic development, and environmental sustainability, offering a comprehensive view of its contribution to global sustainability goals. You can learn more about the Gold Standard methodologies here.

American Carbon Registry (ACR)

The American Carbon Registry (ACR) provides a robust framework for carbon offset projects across various sectors, emphasizing transparency, scientific integrity, and environmental benefits. ACR’s approved methodologies cover a diverse array of project types, ranging from forestry and land use, renewable energy, energy efficiency, to methane capture and avoidance.

These methodologies are designed to ensure that projects can accurately measure and report greenhouse gas (GHG) avoidance or removals. ACR places a strong emphasis on innovation and practicality in its methodologies, allowing for the development of new approaches to carbon reduction that can be rigorously quantified and verified. This includes pioneering methods for forest carbon, improved agricultural practices, and the reduction of emissions from industrial and municipal operations.

ACR’s methodologies not only support projects in quantifying their carbon impact but also encourage the adoption of practices that contribute to environmental sustainability and conservation, aligning project outcomes with broader climate goals. You can see all approved ACR methodologies here.

Climate Action Reserve (CAR)

The Climate Action Reserve (CAR) offers a suite of protocols designed to ensure the environmental integrity and real, verifiable, and quantifiable climate benefits of carbon offset projects within the United States and Mexico. These protocols cover a diverse array of project types, including forestry, urban forestry, livestock, grassland, rice cultivation, and more, reflecting a wide range of activities that can generate measurable carbon reductions or sequestration.

CAR’s protocols are meticulously developed through a stakeholder-driven process, emphasizing transparency, accuracy, and feasibility in measuring and verifying carbon offsets. By setting clear guidelines and standards for the development, quantification, and verification of offset projects, CAR facilitates the creation of high-quality carbon credits that contribute to the mitigation of greenhouse gas emissions.

These protocols not only support project developers in creating projects that have a tangible impact on carbon reduction but also help instill confidence among buyers and stakeholders in the integrity and environmental benefits of the offsets generated. You can see all CAR protocols here.

Plan Vivo

Plan Vivo is a leading standard for community-led natural climate solutions, emphasizing projects that not only sequester or avoid carbon emissions but also enhance local livelihoods and biodiversity. The Plan Vivo Standard offers a framework tailored specifically for projects involving land use, land-use change, and forestry.

Its methodologies focus on activities such as reforestation, afforestation, agroforestry, and improved forest management. These methodologies are designed to quantify carbon benefits accurately while ensuring the projects deliver tangible social and environmental co-benefits.

By adopting Plan Vivo’s methodologies, projects can demonstrate their commitment to empowering local communities, preserving ecosystems, and contributing to a sustainable future. This approach aligns closely with Plan Vivo’s vision of integrating carbon mitigation efforts with socio-economic development and environmental conservation, offering a holistic path to addressing climate change. You can see all Plan Vivoe climate methodologies here.

4. Validate And Verify

To ensure the credibility of carbon credits, projects must undergo a two-step process: validation and verification.

- Validation occurs before a project begins, assessing the project plan and its potential to avoid or remove carbon emissions according to specific criteria.

- Verification, on the other hand, happens after the project has been implemented, evaluating the actual emission reductions achieved.

This process is carried out by independent third-party organizations, which are not affiliated with the project itself, to avoid conflicts of interest. These third parties must be accredited to verify against recognized standards, such as Verra’s Verified Carbon Standard (VCS) or the Gold Standard.

Their role is critical in ensuring the integrity of the carbon credits by confirming that the project’s emission reductions are real, measurable, and additional (beyond what would have occurred without the project).

5. Register with a Carbon Standard

After a project has been validated and verified, the next step is to formally register it with a recognized carbon standard, like those mentioned above. This is a crucial step, as it officially recognizes the project’s contributions to carbon reduction and enables the issuance of carbon credits.

Registration involves submitting extensive project documentation and verification reports to the chosen standard body, such as the Verra Carbon Standard (VCS), Gold Standard, American Carbon Registry (ACR), Climate Action Reserve (CAR), or Plan Vivo. Each of these bodies has its own set of requirements and protocols for project registration, designed to ensure the highest levels of environmental integrity and credibility.

Upon successful registration, the project is listed in the standard’s registry, and carbon credits are issued accordingly. These credits can then be sold on various platforms, including direct sales to businesses seeking to offset their emissions or through carbon credit brokers. The price of carbon credits is influenced by factors such as the project type, its location, and the current demand in the carbon market.

6. Issue Carbon Credits

After registration, carbon credits are issued into your account within the carbon standard’s registry. Each credit represents one tonne of CO2 (or equivalent) avoided or removed from the atmosphere.

Here’s a detailed guide on what to do once you’ve reached this stage:

- Submit a Request for Credit Issuance: After your project has been registered with your chosen carbon standard (e.g., Verra, Gold Standard, Plan Vivo), you’ll need to formally request the issuance of carbon credits. This typically involves submitting a final verification report prepared by a third-party verifier, which confirms the amount of greenhouse gas emissions your project has avoided or removed.

- Ensure Compliance with Reporting Requirements: Make sure all required documentation is up-to-date and fully compliant with the carbon standard’s guidelines. This documentation often includes monitoring reports that detail the project’s performance and the methodologies used to calculate the emission reductions or removals.

- Pay Any Applicable Fees: Most carbon standards charge fees for credit issuance. These fees vary depending on the standard and the number of credits issued. Ensure you understand these costs upfront and incorporate them into your project’s financial planning.

- Review by the Carbon Standard: The carbon standard will review your request for credit issuance along with the supporting documentation and verification report. This review process ensures that all criteria have been met and that the emission reductions or removals claimed are accurate and valid.

- Credit Issuance into Your Registry Account: Once the review process is complete and your project is approved, the carbon credits will be issued into your account within the carbon standard’s registry. Each issued credit represents one metric tonne of CO2 (or equivalent) that has been avoided or removed from the atmosphere.

- Track Your Issued Credits: Carbon standards maintain online registries where issued credits are recorded and tracked. These registries provide a transparent platform for managing and transferring credits. It’s crucial to familiarize yourself with the registry system associated with your carbon standard to effectively manage your credits.

- Prepare for Sale or Retirement: With the credits officially issued, you can now choose to sell them to entities looking to offset their emissions or retire them to claim the environmental benefit towards your own or a client’s carbon neutrality goals. If you decide to sell, you’ll need to transfer the credits from your account to the buyer’s account within the registry system, often facilitated by legal agreements and financial transactions.

- Continuous Monitoring and Reporting: Even after credits are issued, it’s important to continue monitoring your project’s performance and reporting on its impacts, as required by the carbon standard. This ongoing process is essential for maintaining the credibility of your project and for the issuance of additional credits in the future.

7. Sell Carbon Credits

Once you have your carbon credits issued, you can market and sell your carbon credits. The easiest way to do this is through the registry of the carbon standard you are registered with. Here are the most common ways to sell carbon credits:

- EcoCart for Ecommerce Offsets: Specifically designed to connect impact projects with ecommerce businesses looking to offset their carbon footprint with verified carbon credits.

- Verra’s Verra Registry: Ideal for projects verified under Verra’s standards, including those related to the Verified Carbon Standard (VCS).

- Gold Standard Impact Registry: A platform for selling carbon credits certified by the Gold Standard, emphasizing sustainable development benefits.

- The Climate Action Reserve (CAR): Offers a registry system for projects verified under its standards, facilitating the sale of carbon credits in North America.

- Plan Vivo’s Plan Vivo Registry: For projects certified under Plan Vivo standards, focusing on community-led land use projects.

- Carbon Trade Exchange (CTX): An online platform facilitating the buying and selling of certified carbon credits in a transparent and efficient carbon marketplace.

- Markit Environmental Registry: Provides a secure platform for the issuance, transfer, and retirement of environmental assets like carbon credits.

- CBL Markets: An exchange platform that provides access to various environmental commodity markets, including carbon offsets.

- SCX (Swiss Carbon Exchange): A marketplace for trading carbon credits, focusing on high-quality standards and transparency.

- Puro.earth: A platform focusing on biochar, wooden building materials, and other forms of carbon removal credits, connecting sellers with corporate buyers.

- European Energy Exchange (EEX): As the successor to the European Climate Exchange, EEX provides a comprehensive platform for trading in carbon allowances under the EU ETS, offering a transparent and regulated market for compliance obligations within the European Union.

8. Report and Monitor

Continuously monitor and report on your project’s performance according to the requirements of the carbon standard. This may involve regular verification to generate additional carbon credits worth using over time.

- Develop a detailed monitoring plan outlining metrics to measure, such as carbon sequestration or emission reductions, and select appropriate tools and technology for accurate data collection.

- Schedule regular site visits to inspect project activities and their effectiveness, complemented by periodic audits conducted by external third-party verifiers as required.

- Adhere to the specific monitoring and reporting guidelines of your chosen carbon standard to ensure compliance and maintain the validity of your carbon credits.

- Update the project’s registry with new data after each monitoring period to keep the project status and credit issuance current.

- Analyze performance data regularly to assess the project’s impact, identify areas for improvement, and adjust strategies accordingly to enhance effectiveness.

- Maintain open communication with local communities and other stakeholders, providing transparent updates on project progress, impacts, and adjustments.

- Report regularly to investors, supporters, and the public through appropriate channels to demonstrate the project’s achievements and address challenges.

- Keep comprehensive records of all monitoring activities, data collected, and any significant actions taken, ensuring readiness for the official third-party verification process.

- Conduct an internal pre-verification audit to anticipate and rectify any potential issues before the formal verification by accredited third-party auditors.

By integrating these practices into your project management, you ensure continuous compliance with carbon standards, maintain the integrity of the carbon credits generated, and contribute to the efficacy and reliability of carbon offsetting initiatives.

Common Questions About Getting Paid For Carbon Credits

Who buys carbon credits?

A diverse group of entities seeking to offset their carbon emissions, meet regulatory requirements, or achieve sustainability goals purchase carbon credits. This includes:

- Corporations from various industries aiming to reduce their carbon footprint and comply with environmental regulations.

- Governments and municipalities looking to meet national or international climate targets.

- Small and medium-sized enterprises (SMEs) committed to environmental responsibility.

- Individuals who are environmentally conscious and wish to offset their personal carbon emissions, such as from travel or home energy use.

- Non-governmental organizations (NGOs) and environmental groups investing in carbon reduction projects to support their climate action goals.

How many carbon credits per acre of trees?

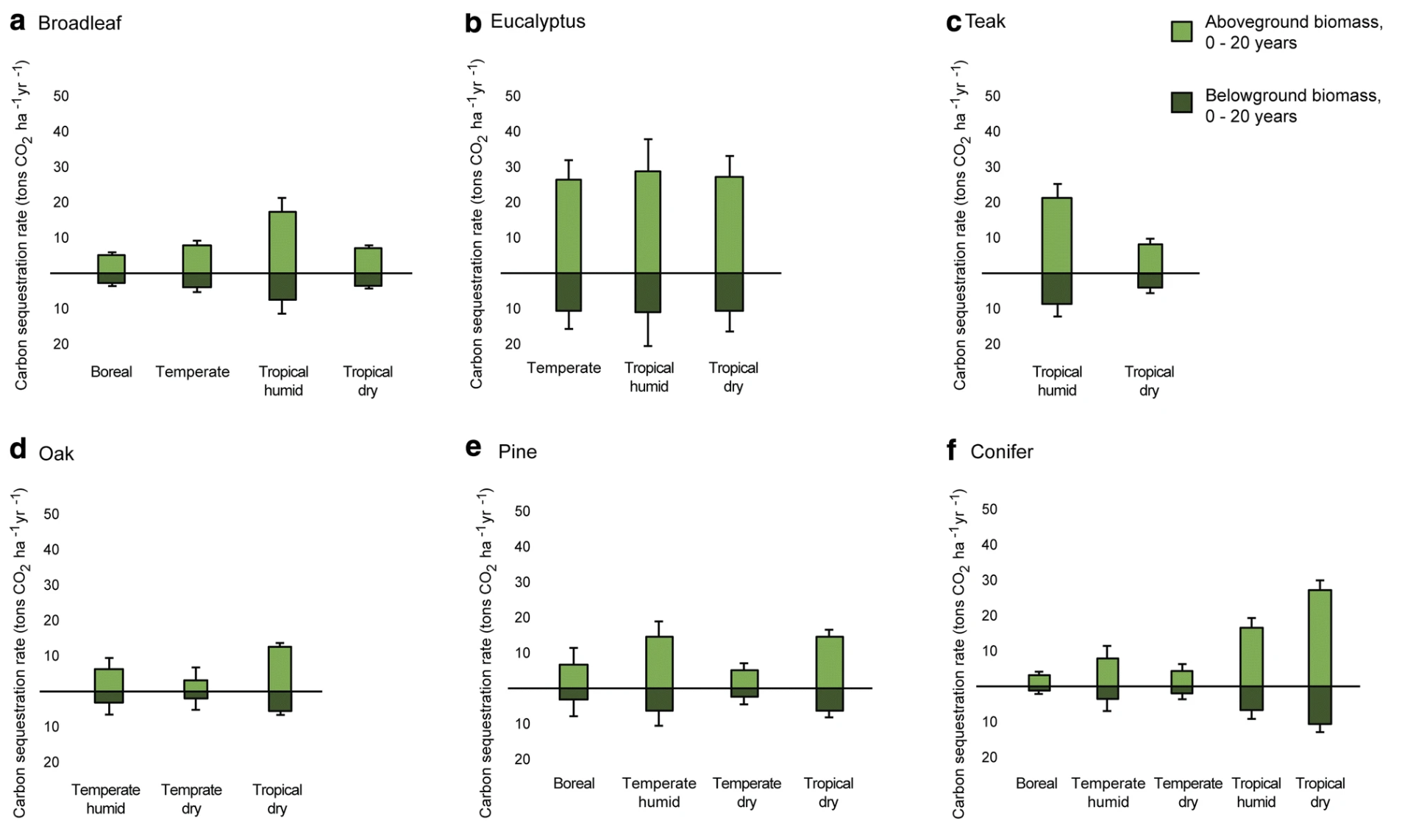

The number of carbon credits generated per acre of trees varies significantly depending on several factors, including the type of trees, the age of the forest, the climate, and the forest management practices. On average, a well-managed forest can sequester about 1 to 10 metric tonnes of CO2 per acre per year. Since one carbon credit represents the sequestration of one metric tonne of CO2, this translates to roughly 1 to 10 carbon credits per acre per year. However, precise calculations require detailed assessments and adherence to specific methodologies set by carbon standards to ensure accuracy and verifiability.

Can I sell carbon credits from my land?

Studies suggest that agricultural soils could sequester over a billion additional tonnes of carbon each year, highlighting the potential of carbon farming as a revenue stream. What’s more, a report suggests the US agriculture and forestry sector alone can provide 10-20 percent of the emissions reduction needed to reach net zero by 2050.

This provides landowners and farmers with a unique opportunity.

They can generate revenue by selling carbon credits through carbon farming and sequestration processes. The practices used in these processes remove CO2 from the atmosphere by converting it into organic matter within the soil and plants, ultimately restoring the soil’s natural qualities, improving crop production, and reducing greenhouse gas emissions in the atmosphere.

To enroll in these programs, landowners and farmers must provide documentation of their carbon offset projects, such as proof of emission avoidance or removals, as well as legal and ownership information.

Determining the volume and value of carbon offsets produced through each of these methods can be challenging. Again, this is where a third-party verifier, like the ones we mentioned above, comes in. First, a third party must validate that the carbon offset project design will in fact avoid or remove carbon dioxide as promised. Then, third-party verifiers will collect and analyze data from the property and sometimes even conduct a site visit to determine eligible offsets.

Here are a few examples of projects that landowners and farmers can undertake:

- Using conservation tillage or no-tillage practices

- Participating in agroforestry

- Instead of removing or burning, returning biomass to the soil as mulch after harvest

- Using nutrient management and precision farming

- Altering manure management and changing feeding schedules

- Switching to lower-carbon fuel types

So how much revenue can these projects generate? Let’s answer this question by posing a slightly different question, how many carbon credits per acre of trees?

To answer this, consider a hypothetical forestry project. North Carolina State University estimates the upfront costs to establish a tree plantation at $100-450 per acre or $10,000-$45,000 in total. The USDA and EPA estimate that such a forest can sequester up to 1,000 metric tonnes of carbon annually, potentially generating $15,000-$30,000 per year on the voluntary carbon market. In the worst-case scenario—assuming the highest upfront costs of $45,000 and the lowest annual revenue of $15,000—it would take about three years for the plantation to recover the initial investment and start turning a profit.

Of course, this is a very rough estimate—markets and carbon pricing are prone to fluctuation, different varieties of trees grow at different rates, environmental conditions change, and, as a result, carbon absorbs at differing rates, meaning revenue will vary. A recent study demonstrates this “Planted forests and woodlots were found to have the highest CO2 removal rates, ranging from 4.5 to 40.7 t CO2 ha−1 year−1 during the first 20 years of growth.”

Learn more about the different types of carbon offset projects.

Get Started With EcoCart

If you’re interested in reducing your business’s carbon footprint, download our guide on leveraging sustainability across the customer experience to learn more. Contact us to see if your offset project is a good fit for our carbon offsetting widget for ecommerce businesses.